Image source: https://image.slidesharecdn.com/slides-170215010438/95/customer-churn-analytics-using-microsoft-r-open-10-638.jpg?cb=1487289461

Customers are the backbone of any firm, devoid of reference to whether magnificent or small, technical or normal, agency or a sole proprietorship. All matter on the spare time physical games in their invaluable purchasers. The primacy of the users has taken establishments from Scratch to Gold, helping them build a became privy to obtainable at hand within of the marketplace for or to even shop an photograph for an already classy super. Firms have to make specific that their purchasers are chuffed and glad in any the assorted case they could reach their lowest level. For this very the cause why, a full lot of establishments and companies have indulged in a observe to assure their purchasers dont buzz clear in their firm and their pageant dont take wisdom in their nonchalance. This Practice is is assumed as Customer Turn or, a greater recognized term within of the firm world, Customer Churn. Customers being withered away to pageant are a average sight and this is customarily the reason establishments world intensive differentiate between two wished sides of Customer Churn, Voluntary Churn and Involuntary Churn. The former pertains to the shortcoming of an existing purchaser due to the the sequence of the purchaser himself, whilst the latter takes place resulting from cases not within of the palms of the agency or the firm or the merchant. Healthy establishments continue a observe file in their purchasers, and their analysts mostly seek their databases for any loopholes giving birth to damaging cases which provide up in Customer Churn. This methodology is is assumed as Customer Churn Analysis.

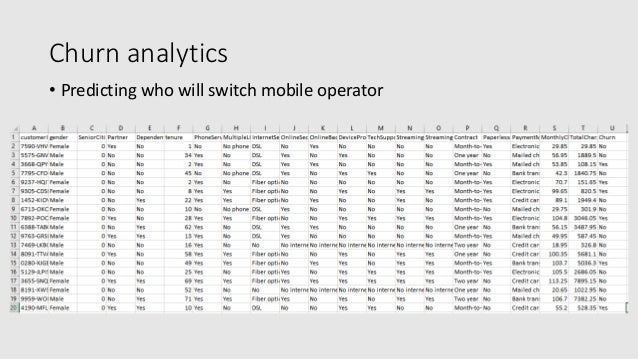

Organizations have separate departments and wings to glance after the calls for and capabilities for this very goal. Banks, phone and wireless service establishments, Internet Service Providers, cable TV establishments, alarm monitoring capabilities, and so on. are choicest examples of establishments which use this advantageous characteristic of learning Customer Churnin the promotion world. By learning the problem of the purchaser base, the gurus and analyst make a fixed investigation between Gross and Net Churn or Turn. Gross Churn is the shortcoming of existing purchasers and their linked or linked recurring earnings for goods or capabilities same thru a period within of the monetary 12 months. Net Churn on another hand is Gross Churn plus the addition of equivalent purchasers on the outstanding location within of a equivalent time period of the monetary 12 months. With the fee of retaining an existing purchaser being some distance underneath gaining a firm new one and then affirming up it, a wise agency is one which fits on affirming up purchaser base relatively than creation a firm new one reasonably. Business acumen turns into a key aspect in identifying devoid of reference to whether a purchaser remains or steers away into opposition territory. The desire of suppose tanks and separate departments discussed till now are wished and for that very the cause why.CustomerRetention Strategies are used by the establishments to make assured they purchasers the basic consciousness. Financial establishments, for instance, recurrently observe and diploma Customer Churn riding a weighted calculation is assumed as Recurring Monthly Revenue (RMR).